How To Fill Out W4 Form To Get More Money During The Year

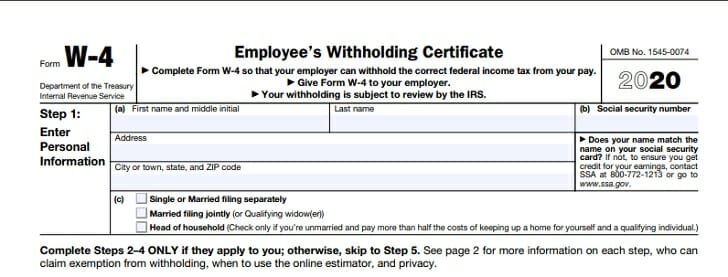

If you lot're filling out a Form W-4, you probably only started a new task. Or maybe you recently got married or had a baby. The W-4, too called the Employee's Withholding Certificate, tells your employer how much federal income tax to withhold from your paycheck.

The form was redesigned for 2020, which is why it looks dissimilar if y'all've filled one out earlier then. The biggest change is that it no longer talks about "allowances," which many people constitute confusing. Instead, if you lot want an boosted amount withheld (perhaps your spouse earns considerably more than you), you simply state the amount per pay period. Here, we answer frequently asked questions well-nigh the W-four, including how to fill up it out, what'southward changed and how the W-4 is dissimilar from the W-2.

Go beyond taxes to build a comprehensive financial programme. Discover a local fiscal advisor today.

Why Exercise I Need to Fill Out Form West-four?

As merely noted, the grade tells your employer how much federal income tax to withhold from your paycheck. You'll demand to complete a new Due west-4 every time you showtime a new chore. If your new visitor forgets to requite yous one for some reason, be certain to ask. If your employer doesn't accept a W-4 form from you, the IRS requires information technology to care for you equally a single taxation filer, which means withholding the highest possible corporeality from your paycheck for taxes. You lot can get back the amount yous overpay, but only in the new twelvemonth when you file your tax return.

Do I Need to Submit the New Grade W-iv?

You should complete the redesigned W-4 simply if you started a new job – or if your filing condition or fiscal situation has changed. You do not need to make full out the new form if you accept not changed employers. Your visitor can still use the information provided on the former W-four form.

How Long Does It Have for W-4 Changes to Exist Implemented?

When you submit a W-4, you can look the information to go into effect adequately apace. Merely how long exactly before your paycheck reflects the changes largely depends on your payroll system. Ask your employer when you turn in the grade.

How Is the New W-4 Dissimilar from the Old W-iv?

The biggest change is the removal of the allowances department. You no longer need to calculate how many allowances to claim to increase or decrease your withholding. The new grade instead asks you lot to signal whether you have more than ane chore or if your spouse works. It also asks how many dependents you have and if y'all have other income (not from jobs), deductions or extra withholding. The new form too provides more privacy in the sense that if you do not desire your employer to know you have more than ane task, you do not turn in the multiple task worksheet.

How to Make full Out the Westward-4?

As far as IRS forms go, the new W-4 course is pretty straightforward. It has only five steps. If you are single, have one job, have no children, accept no other income and programme on claiming the standard deduction on your taxation return, you merely demand to fill out Footstep one (your proper noun, address, Social Security number and filing status) and Step v (your signature).

If you have more than than one job or your spouse works, you'll need to fill up out Step ii. If you have children, Step 3 applies to you. And if you lot have other income (non from jobs), you'll be itemizing your deductions on your taxation return or yous desire an extra corporeality withheld (including from other jobs), you can signal your adjustments in Step 4.

How to Fill up Out Footstep 2: Multiple Jobs or Spouse Works?

If your spouse works and you file jointly or if you lot accept a second or third task, y'all can utilize either the IRS app or the 2-earners/multiple jobs worksheet (page 3 of the W-4 instructions) to summate how much extra should exist withheld (you put this amount in Step 4). If at that place are but two jobs (i.east., you and your spouse each take a job or you have two), you but check the box. (Your spouse should exercise the same on his or her grade or you check the box on the Westward-iv for the other job, as well.)

How to Make full Out Footstep 3: Merits Dependents?

You fill this out if yous earn $200,000 or less (or $400,000 or less for joint filers) and have dependents. It's a simple calculation where you lot multiply the number of children under age 17 by $2,000 and the number of other dependents past $500 – and add the two sums.

How to Fill up Out Step 4a: Other Income (Not from Jobs)?

If you take interest, dividends or upper-case letter gains that you'll owe taxes on, you can bespeak the full amount of not-pay income here. Your employer volition figure it into how much taxes to withhold from your paycheck.

How to Fill Out Step 4b: Deductions?

The deductions worksheet requires some math. You lot'll also demand to know how much you claimed in deductions on your final tax render. If you claimed the standard deduction, yous don't need to fill up this out. If you claimed more than the standard corporeality, this worksheet volition help you calculate how much more. One time you have this corporeality, you lot add any student loan interest, deductible IRA contributions and certain other adjustments. Y'all and so put this total on the course.

If you get stuck, utilise the IRS's withholding app.

How to Fill up Out Step 4c: Actress Withholding?

If you will owe more in taxes than what your salary alone would indicate, y'all can say here how much more you want withheld per pay period. If the extra corporeality is because your spouse works or because you have more than than one job, y'all enter the amount y'all calculated in Pace 2 – plus whatsoever other amount you desire withheld.

How Does the W-4 Form Differ From the W-two?

Yep, both of these forms start with the letter 'west,' but that'due south where the similarities end.

Unlike a W-four, a Westward-2 form is what your employer fills out for all employees and files with the IRS. It shows your annual earnings from wages and tips. It too states the amounts withheld for Social Security, Medicare, country, local and federal income taxes.

Lesser Line

If you aren't switching jobs or going through life changes, you don't demand to refile your West-4 only because the course has changed. However, all new employees need to fill out a W-iv to avoid overpaying taxes. While the form is more than straightforward and doesn't include allowances like it did in the past, it's still of import to properly and accurately listing information on your W-4.

Tax Planning and Your Fiscal Plan

- Income taxes are just one aspect of revenue enhancement planning. If you want to preserve what you've earned and grow it in the most revenue enhancement-efficient manner, a financial advisor can assistance. Finding a qualified financial counselor doesn't take to exist hard. SmartAsset's free tool matches you with up to iii financial advisors in your surface area, and you can interview your advisor matches at no cost to make up one's mind which one is right for you. If you're ready to find an advisor who can help yous achieve your fiscal goals, become started at present.

- Starting a new job? Even earlier you fill out your W-4, you can get an judge for how much your accept-home pay will be. Only utilise our paycheck estimator.

Photo credit: IRS.gov ©iStock.com/PeopleImages, ©iStock.com/wdstock

Source: https://smartasset.com/taxes/a-guide-to-filling-out-your-w-4-form

Posted by: trujilloanswert.blogspot.com

0 Response to "How To Fill Out W4 Form To Get More Money During The Year"

Post a Comment